The 10-Minute Rule for Guided Wealth Management

The 10-Minute Rule for Guided Wealth Management

Blog Article

Guided Wealth Management for Beginners

Table of ContentsThe Best Guide To Guided Wealth ManagementGuided Wealth Management for DummiesHow Guided Wealth Management can Save You Time, Stress, and Money.The 7-Second Trick For Guided Wealth ManagementThe Guided Wealth Management Diaries

For investments, make settlements payable to the product company (not your advisor). Giving a monetary consultant total access to your account raises threat.If you're paying a continuous recommendations cost, your consultant must assess your economic circumstance and satisfy with you at the very least annually. At this conference, ensure you review: any changes to your goals, circumstance or financial resources (including modifications to your earnings, costs or assets) whether the level of danger you fit with has actually altered whether your current individual insurance coverage cover is right how you're tracking versus your goals whether any type of adjustments to regulations or monetary products might influence you whether you have actually received whatever they assured in your contract with them whether you need any type of changes to your strategy Every year an adviser should seek your composed authorization to bill you recurring suggestions fees.

If you're moving to a brand-new adviser, you'll need to organize to move your financial records to them. If you need aid, ask your advisor to clarify the procedure.

The Best Strategy To Use For Guided Wealth Management

As an entrepreneur or tiny company proprietor, you have a whole lot going on. There are numerous obligations and expenditures in running an organization and you definitely don't need one more unnecessary expense to pay. You need to meticulously take into consideration the return on financial investment of any type of solutions you reach make certain they are rewarding to you and your business.

If you're one of them, you may be taking a massive danger for the future of your business and yourself. You might intend to continue reading for a list of reasons working with a financial advisor is useful to you and your business. Running a company has lots of difficulties.

Money mismanagement, cash money flow troubles, overdue settlements, tax concerns and other monetary issues can be important sufficient to close a service down. There are numerous means that a qualified economic consultant can be your companion in aiding your organization grow.

They can collaborate with you in evaluating your financial circumstance on a routine basis to stop significant blunders and to promptly fix any type of bad money decisions. The majority of small company proprietors use lots of hats. It's reasonable that you wish to save cash by doing some tasks yourself, but dealing with financial resources takes expertise and training.

Getting The Guided Wealth Management To Work

Preparation A company strategy is important to the success of your business. You require it to know where you're going, exactly how you're getting there, and what to do if there are bumps in the roadway. A good financial expert can assemble a detailed plan to assist more helpful hints you run your organization more successfully and prepare for anomalies that develop.

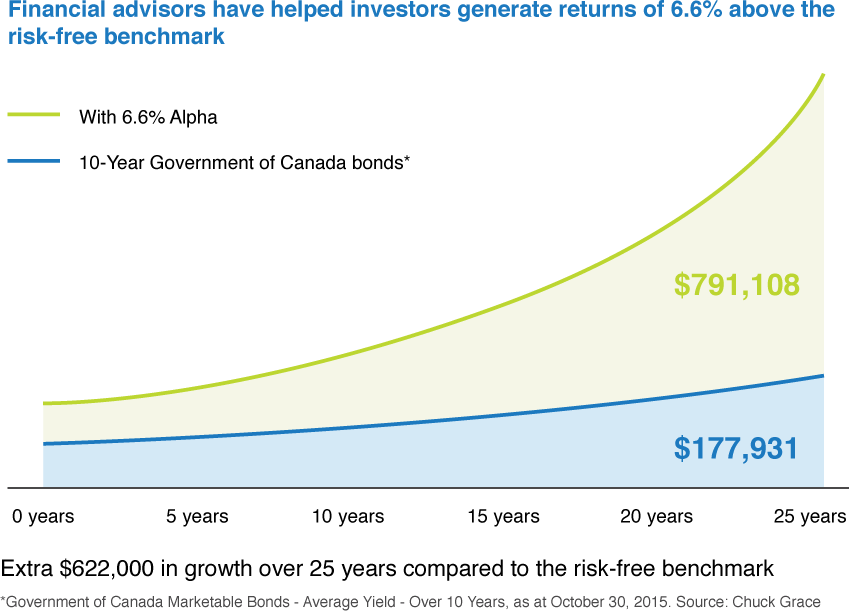

A reputable and well-informed financial advisor can lead you on the financial investments that are right for your service. Cash Cost savings Although you'll be paying a monetary advisor, the long-lasting savings will certainly justify the price.

It's everything about making the wisest economic decisions to raise your chances of success. They can assist you towards the finest possibilities to boost your earnings. Minimized Tension As a company owner, you have great deals of points to worry about (financial advisor brisbane). An excellent monetary advisor can bring you tranquility of mind recognizing that your financial resources are getting the interest they require and your cash is being spent wisely.

Top Guidelines Of Guided Wealth Management

Stability and Growth A qualified monetary expert can provide you quality and aid you focus on taking your service in the best direction. They have the devices and resources to employ techniques that will ensure your business grows and flourishes. They can aid you assess your objectives and establish the best course to reach them.

Some Of Guided Wealth Management

At Nolan Accounting Center, we give experience in all facets of economic preparation for local business. As a local business ourselves, we understand the difficulties you encounter each day. Provide us a phone call today to go over how we can aid your company flourish and be successful.

Independent possession of the practice Independent control of the AFSL; and Independent compensation, from the client just, via a set dollar charge. (https://qualtricsxm2xrp9st39.qualtrics.com/jfe/form/SV_3gTUIzX5EdeV91s)

There are various benefits of a financial coordinator, no matter your scenario. However regardless of this it's not unusual for people to 2nd guess their viability as a result of their placement or present investments. The purpose of this blog site is to prove why every person can gain from an economic strategy. Some typical worries you may have felt on your own consist of: Whilst it is simple to see why people might think this means, it is most definitely wrong to deem them correct.

Report this page